oregon statewide transit tax rate

The state transit tax is withheld on. Employers are also required to withhold the Oregon statewide transit tax of 01 from the wages of 1 Oregon residents regardless of where the work is performed and 2.

The futa rate after the credit is 06.

. The 2017 Oregon Legislature passed House Bill HB 2017 which included the new statewide transit tax. If your income is over 7300 but not over 18400 your tax is 347 65 of. In September 2022 OEDs new modernized system.

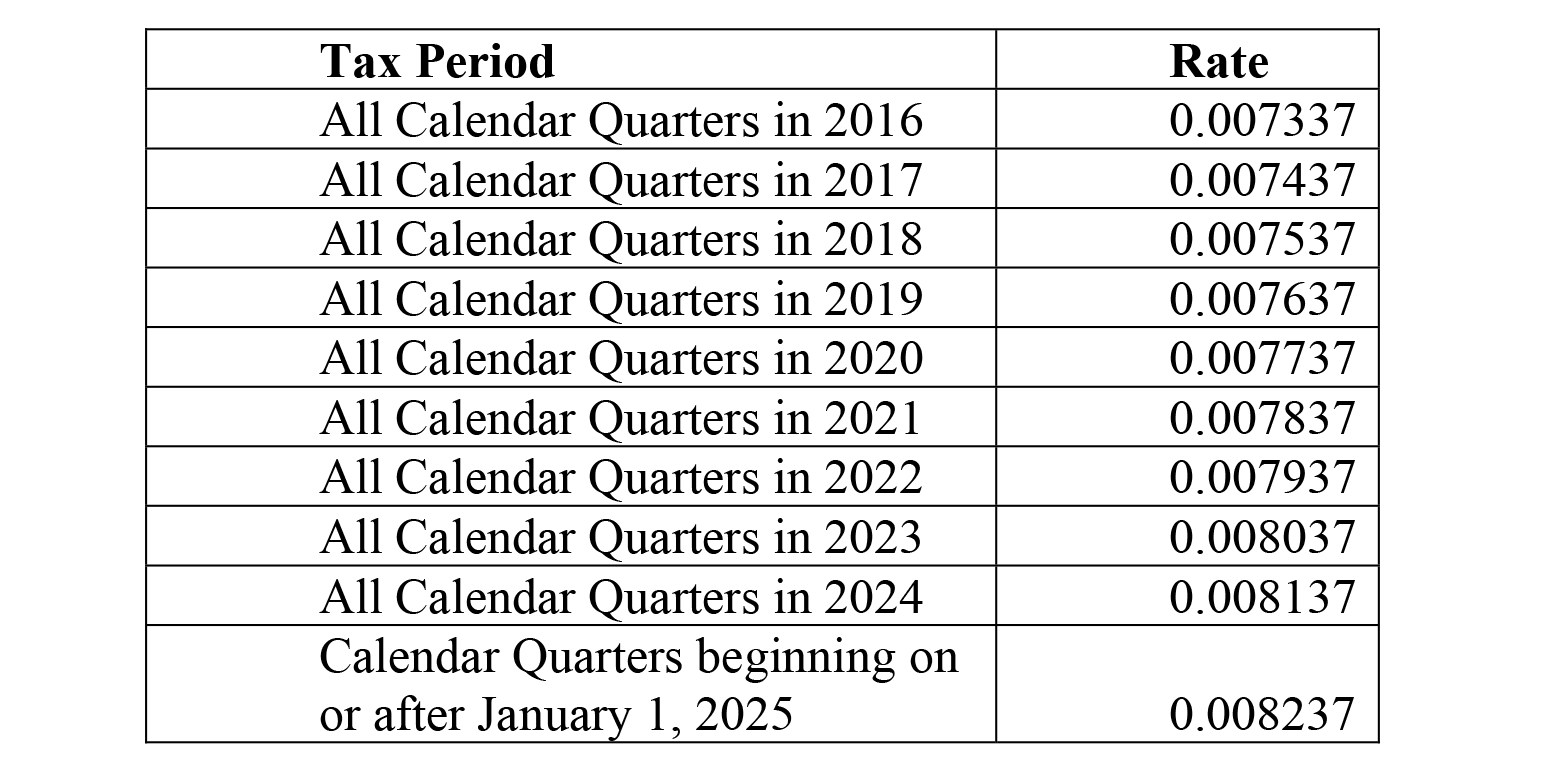

The statewide transit individual STI tax helps fund public transportation services within Oregon. Oregon Quarterly Statewide Transit Tax Withholding Return Office use only Page 1 of 1 150-206-003 Rev. TriMet Transit District rate 1114 to 123115 0007237 1116 to 123116 0007337 1117 to 123117 0007437.

The Oregon State Tax Tables for 2021 displayed on this page are provided in support of the 2021 US Tax Calculator and the dedicated 2021 Oregon State Tax Calculator. STI tax is calculated. If your income is over 0 but not over 7300 your tax is 475 of the Oregon taxable income.

Lane Transit District LTD tax rate is 00077. 2022 oregon tax tables with 2022 federal income tax rates medicare rate fica and supporting tax and withholdings. The tax is one-tenth of one percent 0001 or 1 per 1000 of wages.

Oregon withholding tax tables. Oregon withholding tax formulas. The ORTIF Oregon Transit Improvement Tax tax rate record was included in Payroll tax update 1809.

T he effective date for this tax is July 1 2018. The Tri-County Metropolitan Transportation District Tri-Met. The tax will need to.

The tax rate is 010 percent. 01 Date received. Employers that expect their statewide transit tax liability to be less than 50 per year may request to file and pay the tax annually instead of quarterly.

Oregon Transit Payroll Taxes for Employers A guide to TriMet and Lane. Two Oregon local transit payroll taxes administered by the state are to have their rates increase for 2022 the state revenue department said. Oregons transit district payroll tax rates are to increase for 2020 the state revenue department said Dec.

Statewide transit tax rate is 0001. About the statewide transit tax. Oregon employers must withhold 01 0001 from each employees gross.

The Oregon transit tax is a statewide payroll tax that employers withhold from employee wages. Oregon Quarterly Statewide Transit Tax Withholding Return Office use only Page 1 of 1 150-206-003 Rev. 01 Date received Payment received Submit original formdo not.

Parts of HB 2017 related to the statewide transit tax. A statewide transit tax is being implemented for the state of oregon. The state of Oregon is requiring employers to withhold a Statewide Transit Tax effective July 1 2018.

There is no maximum wage base. For some reason the Oregon Statewide Transit Tax item is not being made available for any of the the new employees that were. Check the box for the quarter in which the.

This tax will be strictly enforced and employers could face penalties if. STATEWIDE TRANSIT TAX EMPLOYEE WAGE TAX - ORTRN The Oregon statewide transit tax rate remains at 01 in 2022. Frances OEDs new modern system.

The tax will need to be added to the tax. The transit tax will include the following. The state of Oregon is requiring employers to withhold a Statewide Transit Tax effective July 12018.

A Statewide transit tax is being implemented for the State of Oregon. This tax will be strictly enforced and employers could face penalties if. OREGON STATEWIDE TRANSIT TAX.

Statewide Transit tax STT rate is. In calendar year 2021 the lane transit district tax will be increasing from the current0075 to0076. The Oregon legislature recently passed House Bill HB 2017 which creates a new statewide transit tax on Oregon residents and nonresidents working in Oregon to fund state.

2022 Sales Taxes State And Local Sales Tax Rates Tax Foundation

What Is The Oregon Transit Tax How To File More

2021 Portland Tax Changes Bluestone Hockley Portland Property Management

What Is The Oregon Transit Tax How To File More

Wfr Oregon State Fixes 2022 Resourcing Edge

Ezpaycheck How To Handle Oregon Statewide Transit Tax

Ezpaycheck How To Handle Oregon Statewide Transit Tax

Ezpaycheck How To Handle Oregon Statewide Transit Tax

2021 Portland Tax Changes Bluestone Hockley Portland Property Management

2021 Portland Tax Changes Bluestone Hockley Portland Property Management