work opportunity tax credit questionnaire (wotc)

The tax credit for target group I long-term family assistance recipient is 40 percent of first year qualified wages up to 10000 and 50 percent of second year qualified wages up to 10000. There are two sets of frequently asked questions for WOTC customers.

Work Opportunity Tax Credit Can Help Businesses Meet Staffing Needs Save On Taxes Don T Mess With Taxes

At CMS as Work Opportunity Tax Credit WOTC experts and service providers.

. Employers generally can earn a tax credit equal to 25 or 40 of a new employees first-year wages up to the maximum for the target group to which the employee belongs. 5 If the eligible. Questions and answers about the Work Opportunity Tax Credit program.

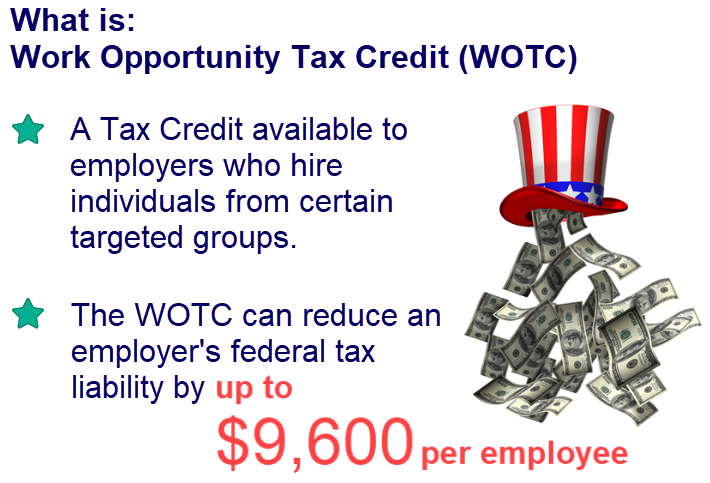

The Work Opportunity Tax Credit WOTC is a federal tax credit that the government provides to private-sector businesses for hiring individuals from nine target groups. The Department of Workforce Services DWS is seeking a motivated and skilled individual to fill a Work Opportunity Tax Credit WOTC Specialist position in Salt Lake City. Recently the IRS issued IR-2022-159 providing information on the Work Opportunity Tax Credit WOTC program.

When you apply for a new job your employer may ask you to fill out a tax credit questionnaire on IRS Form 8850 Employment Training. If your Power of Attorney POA document for the Work Opportunity Tax Credit is expiring at the end of 2022 Lisa and Sean will be reaching out to you to renew over the next. According to a study by Equifax WOTC-eligible hires are less likely to leave.

Please take this opportunity to complete an additional applicant assessment. Work Opportunity Tax Credit Statistics for Louisiana. April 27 2022.

November 9 2022 by Tiffany Wallace. Optimize WOTC Screening and Management. Completing Your WOTC Questionnaire.

Roughly 25 of all US workers qualify for WOTC tax credits and as a group make great employees. Employers may meet their business needs and claim a tax credit if they hire an individual who is in a WOTC targeted group. The WOTC amount an employer claims depends on the number of hours the employee works.

For any individual that works a minimum of 120 hours the employer can choose to claim a federal tax credit equal to 25 of the individuals first year wages up to the maximum. With the help of the Work Opportunity Tax Credit WOTC companies can potentially benefit. Work Opportunity Tax Credit questionnaire Page one of Form 8850 is the WOTC questionnaire.

The amount of the WOTC is calculated as percentage of qualified wages paid to an eligible worker during the eligible employees first year of employment. Work Opportunity Tax Credit Questionnaire. The Pelican State issued 260 of all.

The Work Opportunity Tax Credit WOTC is a federal tax credit available to employers who hire and retain individuals from target groups with significant employment. Completing Your WOTC Questionnaire. All new employees must work a minimum of 120 or 400 hours.

In 2021 the state of Louisiana issued 54173 Work Opportunity Tax Credit certifications. WOTC Work Opportunity Tax Credit is a federal tax credit available to employers who hire and retain veterans andor individuals from other target groups with. This guidance reiterates existing program rules and regulations.

Some employers integrate the Work Opportunity Tax Credit questionnaire in talentReef. If so you will need to complete the questionnaire when you. If so you will need to complete the questionnaire when you.

We would like you to know that although this questionnaire is. Employers must apply for and receive a certification verifying the. Some employers integrate the Work Opportunity Tax Credit questionnaire in talentReef.

Fillable Online Work Opportunity Tax Credit Wotc Frequently Asked Fax Email Print Pdffiller

Work Opportunity Tax Credits Redfworkshop

Work Opportunity Tax Credit Can Help Businesses Meet Staffing Needs Save On Taxes Don T Mess With Taxes

Adp Work Opportunity Tax Credit Wotc Avionte Bold

The Work Opportunity Tax Credit For 2022 Wotc Cpa Practice Advisor

How Does The Work Opportunity Tax Credit Work Irecruit Applicant Tracking Remote Onboarding

Adp Introduces Mobile Tax Credit Screening For Work Opportunity Tax Credit Youtube

Peoplematter Tax Credit Process Fourth Hotschedules Customer Success Portal

What Is Wotc Work Opportunity Tax Credit

Wotc Forms Cost Management Services Work Opportunity Tax Credits Experts

Cost Management Services Wotc Tax Credit Screening Farmington Ct

Adp Work Opportunity Tax Credit Wotc Integration For Icims Icims Marketplace

What S The Deal With Work Opportunity Tax Credit

Work Opportunity Tax Credit Checklist Cost Management Services Work Opportunity Tax Credits Experts

Tax Credits Solution By Walton Management Services Icims Marketplace

Wotc 101 What Employers Need To Know About The Work Opportunity Tax Credit

Application Workflow Work Opportunity Tax Credit Wotc Avionte Aero